AI Tools for Loan Brokers 2025: 10 Smart Assistants to Turbocharge Deal Flow

- Jason Feimster

- Jul 10, 2025

- 5 min read

Updated: Jul 14, 2025

AI tools for loan brokers are exploding in 2025—discover 10 assistants that slash underwriting time, double closings, and leave slow brokers in the dust.

Your biggest bottleneck isn’t prospects—it’s the human behind the keyboard.

The Dawn Patrol: Why Loan Brokers Need AI in 2025

You already know the grind: sourcing warm leads, qualifying without babysitting, structuring a deal that doesn’t blow up compliance, then juggling closing docs while everyone else drops the ball.

Here’s the uncomfortable truth: your competition is automating. You can either sweat it out on manual ops—or install your AI platoon and compound your edge.

This isn’t about replacing brokers. It’s about letting machines chew through admin while you close whales.

Opportunity Snapshot

AI Broker Wins by the Numbers

48% of SMB borrowers in 2025 expect AI-powered application flows Source: Accenture SME Pulse 2025

2.4x higher close rate for brokers using chat-based underwriting Source: HubSpot Lending Report

$950 → $230 drop in average processing cost per file Source: McKinsey FinServ AI Survey, 2024

Meet Your 2025 AI Deal Team

Let’s meet the dream team that’ll let you fund faster, follow up smarter, and stay ten steps ahead of yesterday’s broker.

1. ChatGPT + Custom GPTs: Your Always-On Analyst

Conversational AI trained with your niche underwriting criteria, deal intake formats, and rebuttals.

📊 Use Case

Pre-screen clients via smart intake forms, handle 90% of initial objections, and suggest optimal deal structures based on industry comps.

🧠 Pro Tip

Train a GPT on your past funded deals. Give it rejection reasons. It’ll start spotting red flags before you waste 30 mins on a tire-kicker.

Bryan runs solo and uses a Custom GPT to vet all inbound leads. It spits out risk grades, preferred lenders, and script notes. He went from quoting 4/day to 15/day.

2. Clay: Lead Enrichment on Steroids

Clay connects to your CRM and scrapes 50+ data points from across the web—automatically.

📊 Use Case

Append LinkedIn bios, recent funding events, tech stack, even hiring velocity. Instantly qualify whether a lead is a high-probability buyer.

😈 Contrarian Jab

Still googling prospects manually? That’s like sharpening your spear while everyone else

has drones.

3. Levity: No-Code AI for Repetitive Hell

A no-code AI that can tag, sort, route, and automate decisions based on logic you define—without a single line of code.

📊 Use case

Auto-tag emails, triage docs, qualify inbound PDFs (bank statements, 941s, etc.).

🎯 Direct Impact

Shave 2-3 hours/week off admin overhead. Zero IT team needed.

4. Regie.ai: Turn Cold Leads Into Warm Conversations

AI content assistant trained on your sales scripts and tone.

📊 Use Case

Generate drip sequences, reactivation emails, or response drafts with compliance-safe personalization.

"We used to get 2 responses per 100 cold emails. Now it’s 18. And 3 booked calls.” — boutique CRE broker

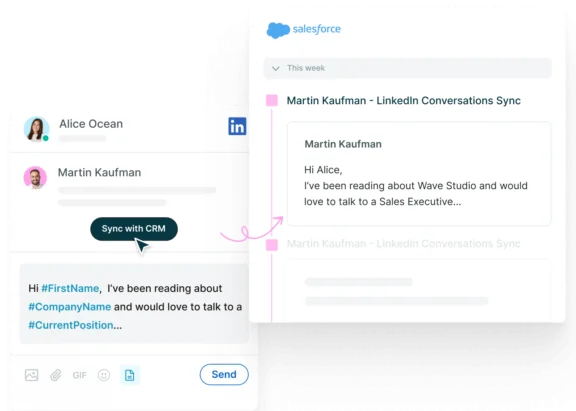

5. Surfe (ex-Leadjet): Sync CRM with LinkedIn

Chrome extension that integrates LinkedIn with HubSpot, Pipedrive, Salesforce.

📊 Use Case

Directly add contacts from LinkedIn with enriched data and notes, sync convos, trigger workflows.

🚀 Fast Win

Cut prospecting time in half and keep CRM freakishly clean.

6. Tactiq: Conversation Capture for Zoom Warriors

AI meeting assistant that auto-transcribes, summarizes, and pulls key insights from Zoom calls.

📊 Use Case

Tag objections, identify decision-makers, generate follow-up emails without rewatching an hour-long call.

🧠 Smart Move

Integrate with Notion or Airtable to keep a living database of client preferences, lenders' quirks, and hidden blockers.

7. Cogram: Loan Doc Summarizer on Crack

AI document parser built for teams who deal with hundreds of contracts, P&Ls, and statements.

📊 Use Case

Instantly summarize business tax returns, detect missing items, or flag non-conforming data.

💀 Dark Truth

That “easy file” deal? You lost 6 hours in doc review. Cogram gives it back.

8. Zapier + OpenAI: Frankenstein Your Own AI Ops

Automation layer between your inbox, CRM, spreadsheets, and AI tools.

📊 Use Case

When a deal comes in, automatically extract data → generate lender match report → send templated intro deck.

⚙️ Mini Case Study

"A small 3-person brokerage set up Zapier flows + GPT prompts to prep lender decks in 2 mins flat. Now they quote 3X more deals."

9. Descript: AI-Powered Content for Authority & SEO

Record your thoughts or client convos and turn them into polished blogs, videos, or social posts.

📊 Use Case

Create thought-leadership without hiring a ghostwriter. Auto-remove filler words, add captions, and export.

📉 Reality Check

If you’re not building topical authority, you’re a replaceable sales agent, not a deal magnet.

10. AskFundu: The Lender-Match Whisperer

AI database of loan products, eligibility requirements, and rate conditions across lenders.

📊 Use Case

Type client details, get 3-5 matched lender options with notes, term comparisons, and confidence score.

🔮 Futuristic Edge

Feels like having an underwriter + market analyst + intern in your inbox.

Licensing / Compliance / Partnerships

NMLS & AI Disclosures

Don’t let automation cost you your license. Place NMLS ID disclosures prominently in all AI-generated funnel touchpoints. Use dynamic footers in email cadences and lead forms.

Data Privacy & SOC-2

Before you plug into APIs, confirm vendors are SOC-2 compliant. Stripe Identity, Plaid, and Nav Prime are safe bets. Always have a data-sharing policy linked in every intake flow.

Affiliate & ISO Integrations

Partner up, smartly. Integrate tools with DAC, 7 Figures Funding, and Uplyft Capital to expand funding lines while retaining branding.

Model Risk Management

Keep GPTs from hallucinating APRs or overpromising terms. Use sandbox testing, prompt templates, and a human-in-the-loop QA step before anything client-facing goes live.

ROI / Money Math

Stage | Hours Saved/Deal | Old Cost | AI Cost | Net Gain |

Lead Prospecting | 3 h | $120 | $18 | $102 |

KYC & Docs | 2 h | $80 | $12 | $68 |

Underwriting | 4 h | $160 | $30 | $130 |

Follow-up & Admin | 2 h | $80 | $10 | $70 |

Total/Deal | 11 h | $440 | $70 | $370 |

Common Pitfalls & How to Avoid Them

Shiny-object overload — Don’t install everything on Day 1. Identify your biggest choke point and deploy one AI assistant to fix it.

Blind trust in AI math — Always double-check APRs, fees, and deal logic before presenting to clients.

"Set-and-forget" follow-ups — Cadence emails should feel personal and reflect the prospect’s industry, not sound like they were written by a bot.

Ignoring data-sharing clauses — Failing to review API vendor terms can get you de-partnered by lenders.

Zero training budget — AI doesn’t work magic out of the box. Train your team to prompt, review, and deploy strategically.

FAQs | AI Tools for Loan Brokers

Q1: Are these AI tools compliant with financial regulations?

Most listed tools provide SOC 2 compliance and user-level data control. Always review each tool's privacy policy before integrating with client data.

Q2: Do I need coding skills to use any of these?

Nope. Tools like Clay, Levity, and Zapier are built for non-coders. You can build workflows with drag-and-drop logic.

Q3: Can I train these tools on my past deals?

Yes, especially with GPT-based tools and Cogram. Upload deal docs, rejection reasons, and win criteria.

Q4: How much do these tools cost?

Ranges from $15/month (Tactiq) to $100+/month (Clay or custom GPTs). Most offer free trials.

Q5: What’s the first tool I should try?

Start with ChatGPT + Custom GPTs to handle lead intake. Then add Clay for enrichment. Build from there.

Final Word

The Choice Ain’t Automation vs. Human. It’s Automation vs. Obsolescence.

The average broker is already being outpaced by leaner shops wielding AI like a katana. You don’t need 10 tools. You need the 3 that free up your genius.

Start with one. Then another. Then start compounding.

👊 Stay lethal. Stay human. But get your robot army in line.

Comments